A new study released this week by the Canadian Centre for Policy Alternatives reveals how Indigenous and racialized seniors continue to experience the impacts of colonialism, racism, and sexism even in retirement.

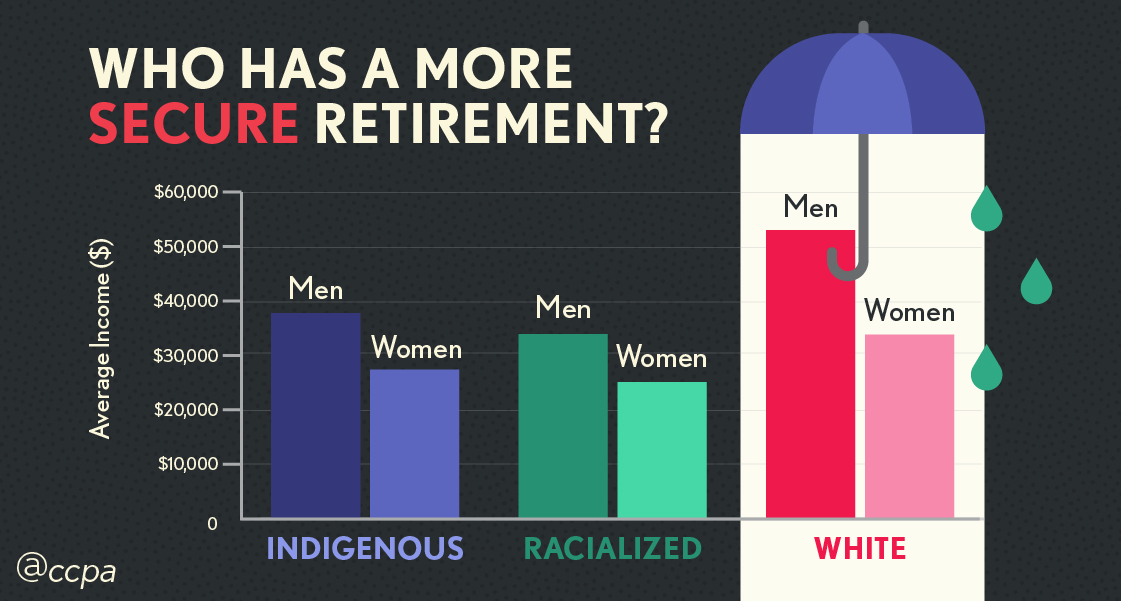

Colour-coded Retirement: An intersectional analysis of retirement income and savings in Canada finds that Indigenous and racialized seniors have less retirement security and higher poverty rates than white seniors.

The gap is even larger for Indigenous and racialized senior women.

“The study clearly shows that retirement security is, in fact, colour coded in Canada,” says report co-author Grace-Edward Galabuzi, who is an associate professor in the Department of Politics and Public Administration at X University.

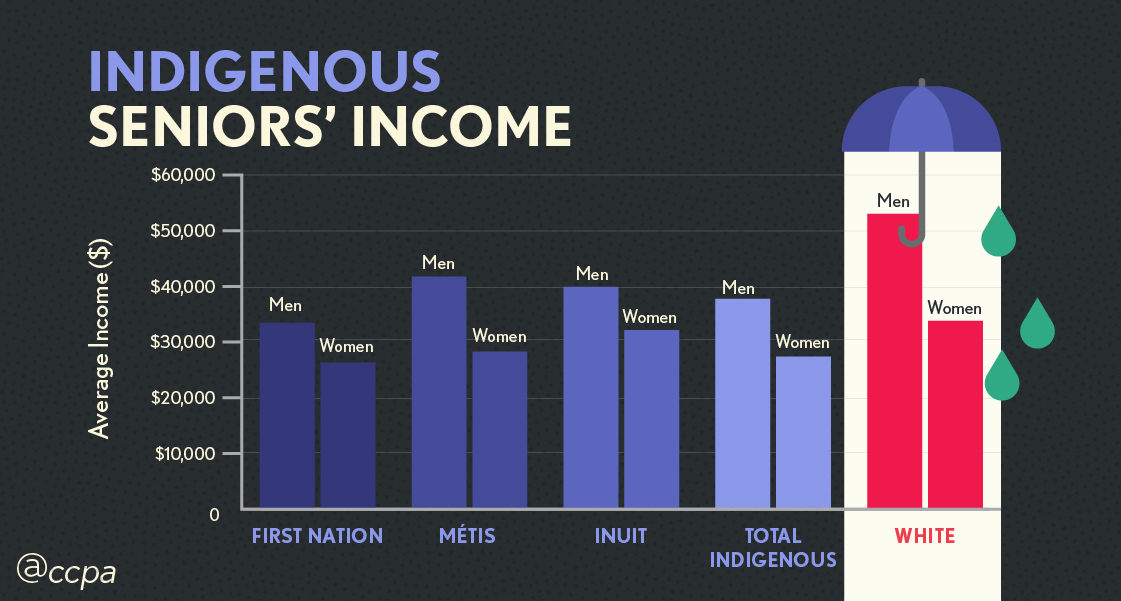

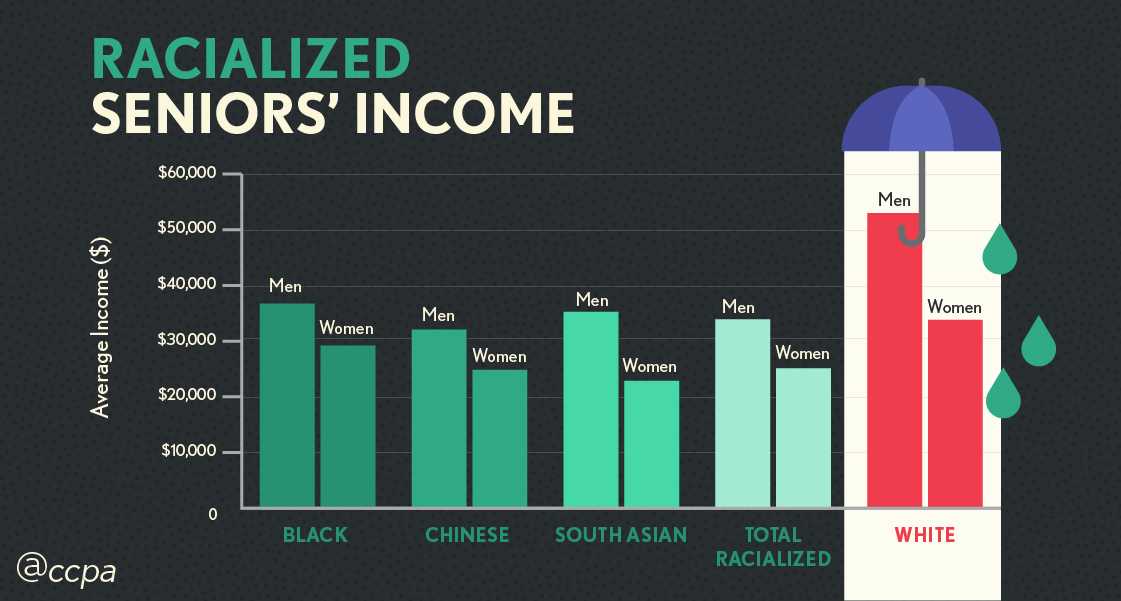

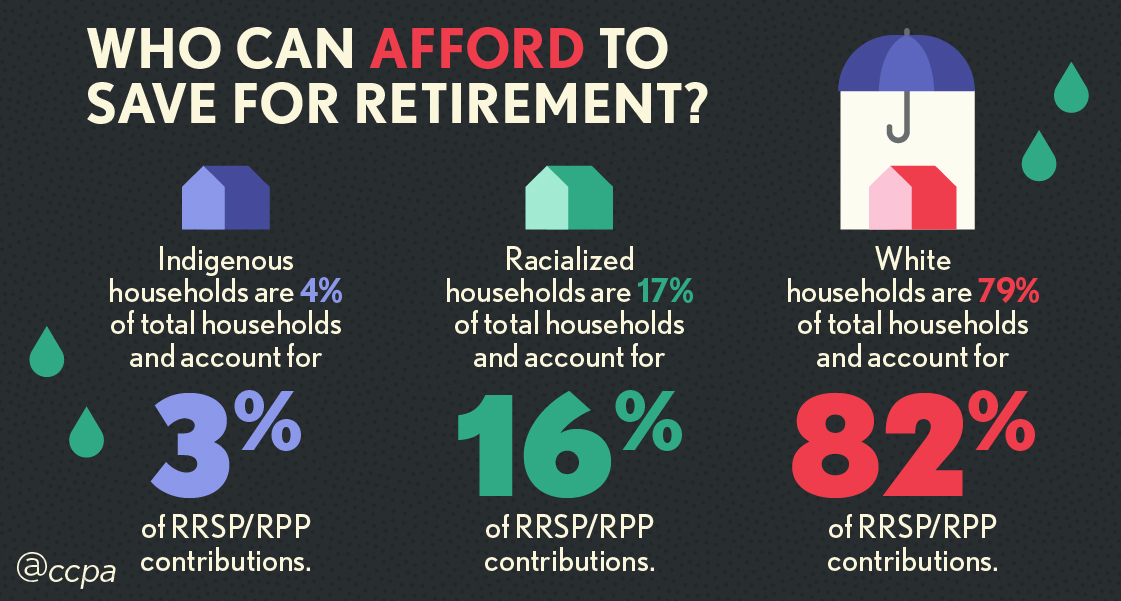

The Colour-coded Retirement report reveals that white seniors enjoy the highest average income compared to racialized and Indigenous seniors. Indigenous and racialized seniors’ average income is 25% and 32% lower, respectively, than senior white Canadians’.

“The data reveals that there are real consequences of economic marginalization and systemic racism. Elders and seniors are financially insecure in retirement, if they can retire at all, because the opportunities for saving are so limited,” says Hayden King, co-author of the report and Executive Director of the Yellowhead Institute.

Senior women had lower income than senior men across the board, while senior Indigenous women’s income averaged 47% of white senior men’s overall.

Senior First Nations women’s average income was 50% of white men’s, while senior Métis women’s was 53% of white men’s and senior Inuit women’s was 61% of white men’s.

Senior Black women’s average income was 55% of white men’s, while senior Chinese women’s was 47% of white men’s and senior South Asian women’s was 43% of white men’s.

The gap in retirement income points to the intersectional impacts of racism and sexism across the life course. Addressing the economic impacts of underlying racism and sexism is needed to achieve equal access to a secure retirement for all.

These efforts will help increase access to good jobs, workplace pension plans and retirement savings. Another part of the solution lies in improving Canada’s public pension plans, since they provide crucial support to marginalized seniors. More and better data collection is also required to better understand retirement savings for Indigenous and racialized people.

“Without these measures, income insecurity will continue to follow Indigenous peoples and racialized Canadians well into their old age,” says report co-author and CCPA-Ontario Senior Economist Sheila Block.

Economic marginalization and lack of viable employment opportunities for most racialized Canadians will have dire effects on their future prosperity, adds Mohammed Hashim, who is Canadian Race Relations Foundation Executive Director. If we continue on this path, it is not only a detriment to their existence; it is a detriment to Canadian society.

There is a need for systemic change for the current pension mechanisms as well as a holistic approach to equitable employment opportunities and adequate wages for racialized Canadians.

Colour-coded Retirement: An intersectional analysis of retirement income and savings in Canada, by Sheila Block, Grace-Edward Galabuzi and Hayden King is available for download on the CCPA website.

The report, which was funded by the Canadian Race Relations Foundation as part of its research mandate in support of the elimination of racism and all forms of racial discrimination in Canadian society, builds on the work of earlier CCPA studies on colour-coded wealth and income inequality in Canada.