Part 3: Landlords systematically use AGI applications to bypass provincial guidelines

Ontario’s rent control regime has many flaws. But there is one piece that stands out above the others: above-guideline increases, or AGIs.

AGIs allow for any landlord to apply for an exemption to provincial rent increase guidelines, and the criteria are extremely lax. In practice, AGIs have been a key driver of landlords’ efforts to hollow out Ontario’s rent control system.

Read the full series

Tenants and housing advocates who call for effective rent regulation face strong opposition. The real estate industry uses simplistic explanations and outdated research to spread myths about rent controls. For ideological reasons, and often without having ever studied the topic, many economists and housing policy analysts further promote these myths. The result is a system of disinformation that has considerable power to influence legislators.

Research findings, on the other hand, support rent regulation. Economic studies of present-day rent controls in Canada and abroad show that they are an effective way to stabilize rents without negative effects.

Divided into six parts

This series is a resource against anti-rent-control propaganda. It is written for tenants and housing advocates, though researchers and policy analysts may also find it useful. It examines rent data in Ontario, explains rent controls, and summarizes relevant research on the topic. The content is divided into six parts that can be read independently and in any order.

Part 1: What is rent control, anyway?

Part 2: Rent control is full of loopholes

Part 3: Above-guideline rent increases are out of control

Part 4: Arguments against rent control don’t hold up to scrutiny

Part 5: Policy solutions and political responses to fix rent control

In 1992, the Ontario government, under Bob Rae’s New Democratic Party, introduced rules allowing landlords to apply for additional rent increases to recover 50 per cent of new capital expenses. In 2006, the Liberal government under Dalton McGuinty changed the rule to allow landlords to transfer the entire cost of capital expenses to tenants, to a maximum of a nine per cent rent increase over three years.

As the name suggests, AGIs are applied on top of the guideline increases. Eligible costs are wide-ranging and inclusive of most capital projects, including renovations (but not maintenance), new security measures, and high property tax increases. AGIs should be removed at the end of the useful life of a renovation, but there are no documented cases of this actually happening.1 As Figure 1 shows, AGI applications have become more common in recent years.

Most AGI applications are for purpose-built apartment buildings and can cover hundreds of units in one application. This means that the number of units impacted is much larger than the number of applications. One study estimated that in Toronto, between 2012 and 2019, AGI applications included 210,000 purpose-built rental units—an estimated 80 per cent of all the purpose-built units in the city.2

A practical example

The landlord spends $200,000 in renovations that impact 20 units. Each unit is expected to pay $10,000. The useful life of the renovation is 15 years. The interest rate applied is 5.2 per cent; $10,000 amortized over 15 years at 5.2 per cent annual interest rates equals $80 a month. Rent in one of the impacted units is $2,000; $80 represents a four per cent rent increase. The AGI regulation allows a maximum of three per cent a year for three consecutive years. The landlords will ask for a three per cent increase in the first year and one per cent in the second year. If, for both years, the rent increase guideline is 2.5 per cent, as in 2023 and 2024, rent increases will add to nine per cent over two years.

The flawed rationale behind AGIs

According to archival research presented in a RenovictionsTO report, Ontario lawmakers have defended AGIs on the basis that landlords need incentives to keep units in good repair, “either because they will not be bothered to (the ‘lazy landlord’) or cannot afford to (the ‘cash-strapped landlord’).” The authors of the report argue that the lazy landlord rationale is indefensible. If landlords willingly fail to live up to their obligations, the cost of their neglect should not be passed on to tenants. Other measures, like inspections and fines, would be more appropriate.3

For its part, the cash-strapped-landlord rationale would require proof that landlords cannot afford to pay for capital projects out of rent revenues. The AGI application doesn’t require such proof. Data on the finances of large landlords show very large profit margins. Smaller landlords rarely apply for AGIs, suggesting that they are not desperate for that additional increase. The cash-strapped-landlord rationale is, thus, a very weak rationale.4

Another argument against AGIs is that renovations increase the value of capital assets that landlords own and from which they derive regular revenue, and that this capital gain should be enough incentive to renovate without imposing rent increases. In addition, landlords have an obligation under the Residential Tenancies Act to maintain the building as part of the lease. Through AGIs, landlords pass the cost of their side of the contract on to tenants.

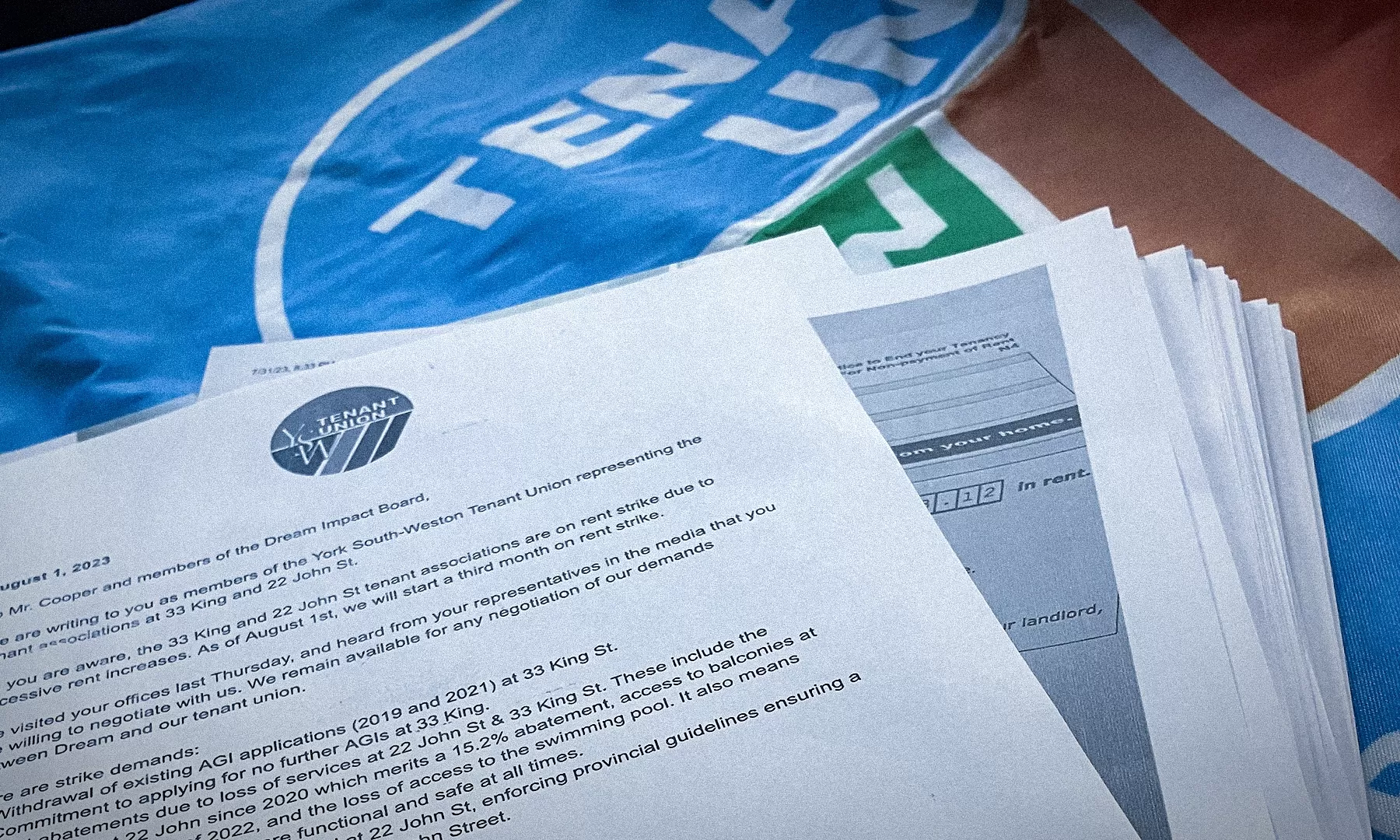

A tenant union member referred to AGIs as eviction by a thousand cuts as they push out tenants who are priced out, tired of fighting abusive increases, or both.5

Our own, additional argument is that AGIs are even less justifiable in the context of vacancy decontrol. With Ontario’s annual turnover rate at nearly 11 per cent and average rent increase in turnover units at 35.6 per cent, owners of multi-residential properties see revenues grow above inflation every year—without AGIs. The creation of a cost pass-through mechanism (which is what economists call above-guideline rent increases) assumes new costs are not routinely passed onto consumers, or that a hard cap exists, like a price freeze. That’s not the case in Ontario. In practice, AGIs allow landlords to double-dip on vacancy decontrol.

Figure 2 illustrates the impact of that double-dipping on average rent increases in Toronto. To isolate the impact of these two loopholes, we looked at rent increases between 2018 and 2022 in two-bedroom units built between 1980 and 1999. By focusing on these buildings, we exclude new units that come into the market at high prices. By focusing on this period, we exclude date-based exemptions that ended in 2017. By selecting two-bedroom units, we exclude the effects of changes in the make-up of the rental stock. In other words, in these units, in this period, landlords could raise rent above the rent increase guideline for only two reasons: turnovers and AGIs.

The total figures on top of the bars show the average annual cost of renting a two-bedroom unit in Toronto each year, according to CMHC data. The blue bars present a hypothetical scenario where, starting in 2017, average rent increases abide by the rent increase guideline. The orange bars show the difference, beginning in 2018, between average rents and what they would have been if Ontario had effective rent control. Over the course of five years, the difference grows to $185 per unit per month or $2,219 per unit per year.

For comparison, in 2022, a minimum wage worker in Ontario had to work 143 hours at $15.50 per hour to earn $2,219. That amount is the equivalent of a month of full-time work.

Real Estate Investment Trusts (REITs) are not shy about describing AGIs and vacancy decontrol as investment strategies. Their financial statements regularly mention it. One recent statement listed “filing above guideline rent increases wherever possible” under “Revenue Opportunities.”6 Another statement read: “In Ontario, the mark-to-market opportunity on turnover contributed to same property [net operating income] growth of 3.8% in the fourth quarter of 2022.”7 There are many other examples of REITs bragging about circumventing rent control. It’s not a secret.

AGI’s flawed calculation formula

The other problem with AGIs is that the numbers don’t add up. The calculation formula— set in Ontario regulation 516/06 of the Residential Tenancies Act (2006), hereafter the regulation—is extremely rudimentary. Major flaws include:

1. The AGI calculation formula ignores the impact of compound rent increases, which generate substantive additional profits for landlords. The calculation of an AGI consists of dividing the total cost of renovations by the total number of units in a building and adjusting for cases where renovations don’t affect all units equally. The amount each unit is expected to pay is divided by the useful life of the renovation, usually 10 to 25 years. The amortization cost is added to that amount; in other words, interest is charged on it. The final amount each unit is expected to pay is then converted into a percentage rent increase based on the unit’s current rent.

Remarkably, the AGI formula ignores the compound impact of annual guideline increases. The formula assumes a fixed payment over time, but rents can increase every year, and when they do, so does the AGI amount. Year after year, increases are applied on top of increases, adding up to much more than the amount tenants were ordered to pay for the renovation.

A practical example

Imagine a three per cent AGI on a $2,000 rent. In the first year, the tenant pays an extra $60 a month to cover the AGI amount. The following year, the rent increase guideline is 2.5 per cent; it applies to the rent and to the AGI amount. The AGI amount grows to $61.50. The following year, with another 2.5 per cent rent increase, the AGI amount grows to $63. The following year, the rent increase guideline drops to 1.5 per cent, yet the AGI amount grows to $64. In only three years, each unit will have paid a total of $102 more in AGI payments than what the Landlord and Tenant Board formula assumes. The common duration of AGIs is 10 to 25 years, and most applications include dozens or even hundreds of units. Over time, compounding rent increases generated substantial additional profits for landlords.

2. Interest costs are assumed, not verified, allowing landlords to profit from the financing of AGIs. The regulation dictates that the interest rate to be used in the amortization calculation is the rate charged for a conventional five-year mortgage at chartered banks. The regulation doesn’t require landlords to disclose their actual financing costs. Since landlords borrow at much lower rates than what chartered banks offer regular families—and this is particularly true for REITs—it is very likely that landlords make additional profit from tenants through the financing of the AGIs.

A practical example

According to the Bank of Canada, for most of 2019, chartered banks charged a 5.2 per cent interest rate on conventional five-year mortgages.8 In the financial statement for that year, one of the largest REITs in the country disclosed that it could refinance its mortgages at a 2.3 per cent interest rate.9 That’s a huge difference. The total interest cost for a $1 million renovation amortized over 15 years at a 5.2 per cent interest rate is $440,000. With a rate of 2.3 per cent, the cost drops to $183,000. Landlords can charge tenants interest rates that are higher than what they themselves pay—and pocket the difference.

3. Landlords can claim the total instead of the additional renovation cost. Dale Whitmore, director of policy and law reform at the Canadian Centre for Housing Rights (CCHR), called our attention to an important error in the formula used to calculate AGIs. The economic theory behind cost-pass-through exemptions stipulates that additional costs brought about by an improvement should be passed onto tenants. The Ontario legislation allows landlords to charge tenants the total cost of an improvement. The two are not the same.

A practical example

Whitmore uses the example of roof replacements. Roof costs are amortized over many years, and that cost is built into the operational costs of units. At the time of the replacement, if an AGI is submitted to cover this improvement, it should cover the additional cost of a new roof. If $15 for the old roof is already included in the rent, and the amortized per unit cost of the new roof is $18, the AGI should cover the additional $3. In practice, AGI applications include the entire cost of the new roof.

A real-life example of flawed AGI calculations

Here we use a real-world AGI to illustrate the impact of interest rates and compounded rent increases. In 2019, in Toronto, the landlord of an apartment building spent approximately $1.5 million on five renovation projects. The AGI application listed 192 affected units. The useful life of the renovation was 19 years. The landlord applied for an AGI of 4.23 per cent. The AGI formula assumes that tenants will make fixed payments, which, by the end of the 19 years, will total $2,150,000.

This $650,000 difference between the renovation cost ($1,500,000) and the amount collected after 19 years ($2,150,000) is the amortization cost, i.e., interest. This amount may or may not correspond to what the landlords have actually paid in interest. No one knows the interest rate landlords are paying because they are not required to disclose their financing costs. More likely than not, landlords pay less than the amount charged because they have access to cheaper credit. As a result, a portion of the $650,000 is additional profit extracted through the financing of the AGI.

Then, there is the impact of compounding rent increases. AGI payments are not actually fixed. Rents increase every year, and the rent increase inflates the AGI amount.

We calculated that annual rent increases on the AGI amount make the total bill grow to $2,518,000, which is $368,000 more than the AGI formula assumes. (Up to 2024, we use the known rent guideline increases; after that, we use the 20-year average of guidelines from 2005 to 2024). In sum, the landlord will collect $2.5 million to cover a $1.5 million renovation.

Ontario lawmakers have argued AGIs are necessary because lazy landlords won’t bother to keep buildings in good repair without a financial incentive and cash-strapped landlords can’t afford such repairs. There is no justification to reward lazy landlords. And no proof is required of AGI applicants that they are actually cash-strapped. The legislation is even more nonsensical in the context of unrestricted rent increases in vacant units. There is no policy rationale for it: AGI exists simply to sweeten the deal for landlords.

And if that wasn’t enough, the formula’s obvious flaws, which ignore the impact of compounding increases, coupled with the lack of transparency about interest rates, allow landlords to profit from renovations.

The special treatment that landlords receive in Ontario is remarkable—especially compared to the treatment of industries that generate more jobs and economic activity. It can only be explained by the enormous influence the real estate industry has exerted over the parties that governed the province.

Our content is fiercely open source and we never paywall our website. The support of our community makes this possible.

Make a donation of $35 or more and receive The Monitor magazine for one full year and a donation receipt for the full amount of your gift.

Notes

- For more on expiring AGIs, see this press conference organized by the Federation of Metro Tenants’ Association (FMTA), torontotenants.org/press_conference_expiring_agis_2019

- Phillip Zigman & Martine August, 2021, “Above Guideline Rent Increases in the Age of Financialization,” p.7.

- Ibid., p., 3, 23.

- Ibid., p., 23-24.

- York South-Weston Tenant Union, March 8, 2024, interview.

- Centurion Apartment REIT, 2021, Annual Report 2020, p.32.

- Boardwalk REIT, 2023, Notice of annual and special meeting of unit holders to be held on May 8, 2023. Newswire.

- Bank of Canada, interest rates posted for selected products by the major chartered banks.

- Boardwalk REIT, 2020, 2019 Annual Report, p.39.