Tax Policy

Our publications are available to all at no cost. Please support the CCPA and help make important research and ideas available to everyone. Make a donation today.

Time to tackle the big fish in an ocean of tax exemptions

When federal Finance Minister Bill Morneau tabled his 2017 federal budget in March, he pledged to make Canada’s tax system fairer. To his credit, he…

Cut preferential tax treatment for the rich: report

CLICK HERE TO VIEW THE FULL REPORT OTTAWA – Preferential tax treatments such as tax exemptions, credits, and loopholes have become a cash cow for…

Il faut mettre un terme aux traitements fiscaux préférentiels, selon un rapport

CLICK HERE TO VIEW THE FULL REPORT OTTAWA – Selon un nouveau rapport du Centre canadien de politiques alternatives (CCPA), les traitements fiscaux préférentiels tels…

Preferential Treatment

The History and Cost of Tax Exemptions, Credits, and Loopholes in Canada Download 813.13 KB 42 pages Preferential tax treatments such as tax exemptions, credits,…

Three loopholes the feds should close (and one they might)

There has been plenty of discussion from the federal government, especially in the lead-up to this week’s budget, about closing tax loopholes (expenditures/breaks/preferences). The 2015…

BC Budget 2017 a missed opportunity

VICTORIA–Budget 2017 is a missed opportunity to address vital issues facing BC families like persistent poverty, unaffordable child care and the crises in seniors’ care,…

The Monitor, January/February 2017

Building a Progressive Tax System Download 7.18 MB It feels a bit counterintuitive, after a tumultuous 2016, to be talking about the mundane matter of…

How closing tax loopholes could pay for a green economy

Our content is fiercely open source and we never paywall our website. The support of our community makes this possible.

Out of the Shadows

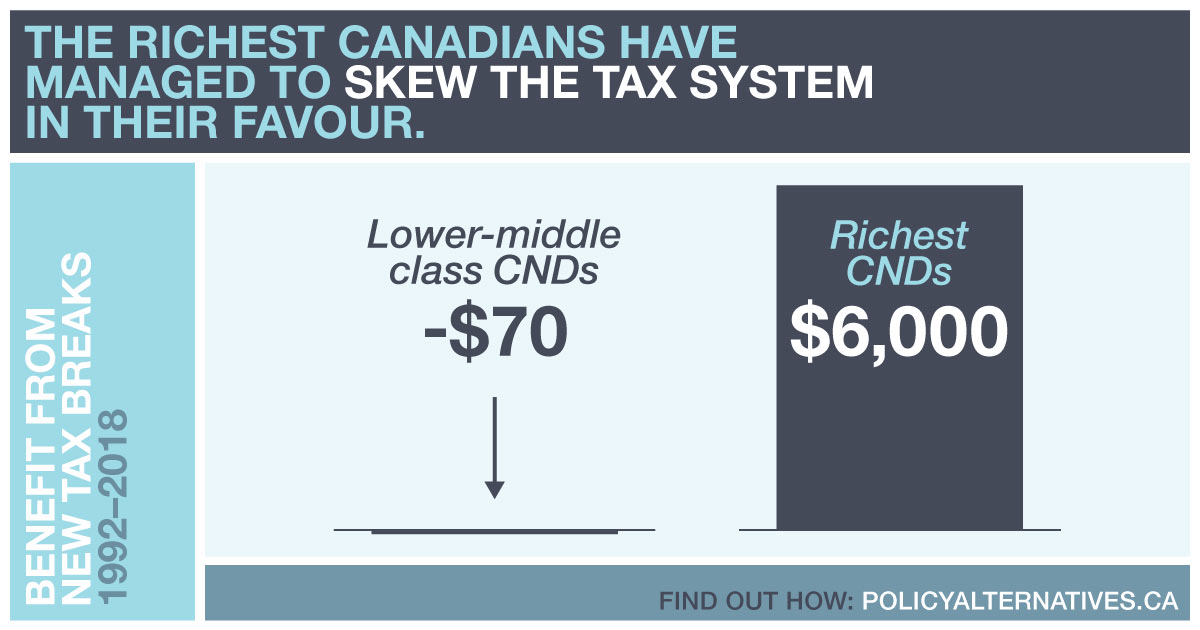

Shining a light on Canada’s unequal distribution of federal tax expenditures Download 1.75 MB58 pages This study finds that Canada’s personal income tax expenditures disproportionately…

Infographic: Who’s in the Loop?

Unfair tax loopholes cost the federal government $103 billion dollars each year—but not everyone’s in the loop. These loopholes disproportionately benefit the rich, and perpetuate…

Updates from the CCPA

Read the latest research, analysis and commentary on issues that matter to you.

CCPA Updates