Our content is fiercely open source and we never paywall our website. The support of our community makes this possible.

Make a donation of $35 or more and receive The Monitor magazine for one full year and a donation receipt for the full amount of your gift.

The Liberal Party recently announced it would, if it forms the next federal government, introduce a nationwide 1% annual speculation tax on residential real estate owned by non-resident non-Canadians. One of the policy’s stated goals is to cool off hot housing markets, especially in Toronto and Vancouver, making it easier for “middle income” households to buy a home. nnWould such a measure be good public policy? Here are 10 things to consider.n

- Much of the real estate speculation pushing up housing prices in Canada is driven by rising wealth inequality. Essentially, lots of wealth has been piling up at the top—among both Canadians and non-Canadians—and real estate is often seen as a sensible avenue for investment (especially by relatively wealthy households).

- A lot of speculation has also been driven by very low interest rates. For roughly the past decade, central banks in the world’s wealthiest countries have kept interest rates very low. This has lowered the cost of borrowing money, making it less expensive to take out a mortgage—meaning demand for home purchases has risen.

- Money laundering has contributed to Canada’s hot housing markets. In other words, people who acquire large amounts of money through illegal means sometimes try to purchase a home with this money, hoping that authorities won’t notice anything peculiar. The B.C. government recently commissioned two reports on this topic—Part 1 can be found here, and Part 2 here.

- A lack of housing supply has also contributed to high house prices. Many measures could increase housing supply, including the further expansion of Canada’s Rental Construction Financing Initiative. Originally announced in the 2016 federal budget (and expanded in the 2019 budget), this program provides low-cost loans for the construction of new rental housing for “middle income” households. These loans are for developers, either non-profit or for-profit, and unit rents must be set 10% below full market potential.

- In theory, there are both advantages and disadvantages to taking a national approach with a speculation tax. An advantage of a national tax is that it makes it less attractive for foreign investors to simply move their investment around from one province to another. (In the words of my good friend Marc-André Pigeon, “it would avoid the Whack-A-Mole game.”) Yet it is also sensible to vary speculation taxes across Canada, depending on local market conditions. After all, if there are signs of intense foreign speculation in one city, but not another, why tax both cities the same way?

- In those Canadian jurisdictions in which house prices have risen sharply, provincial governments have already acted. Vancouver and Toronto are the two Canadian cities that have experienced the most intense house price increases in recent years, and their respective provincial governments have already acted to curb speculation. This raises the question: is it not a little late to be introducing a new speculation tax?

- British Columbia has used multiple policy levers. These measures include a foreign buyers tax of 20% on the sale of the house; a property transfer tax rate of 5% on properties worth more than $3 million, including vacant land; a provincial speculation and vacancy tax of 2% of the assessed value (not all parts of the province are subject to this tax); and a provincial luxury home tax, known as the additional school tax, of 0.2% to 0.4% of the assessed value. There is also a Vancouver municipal vacancy tax of 1% on the house’s assessed value. (For an overview of some of the B.C. initiatives, see this report).

- In April 2017, the Ontario government introduced a 15% speculation tax. This applies on the purchase of residential property in the Greater Golden Horseshoe Region by persons who are neither citizens nor permanent residents of Canada (it also applies to foreign corporations). More information on this initiative can be found here. (Admittedly, there is some talk of the Ontario government removing this tax.)

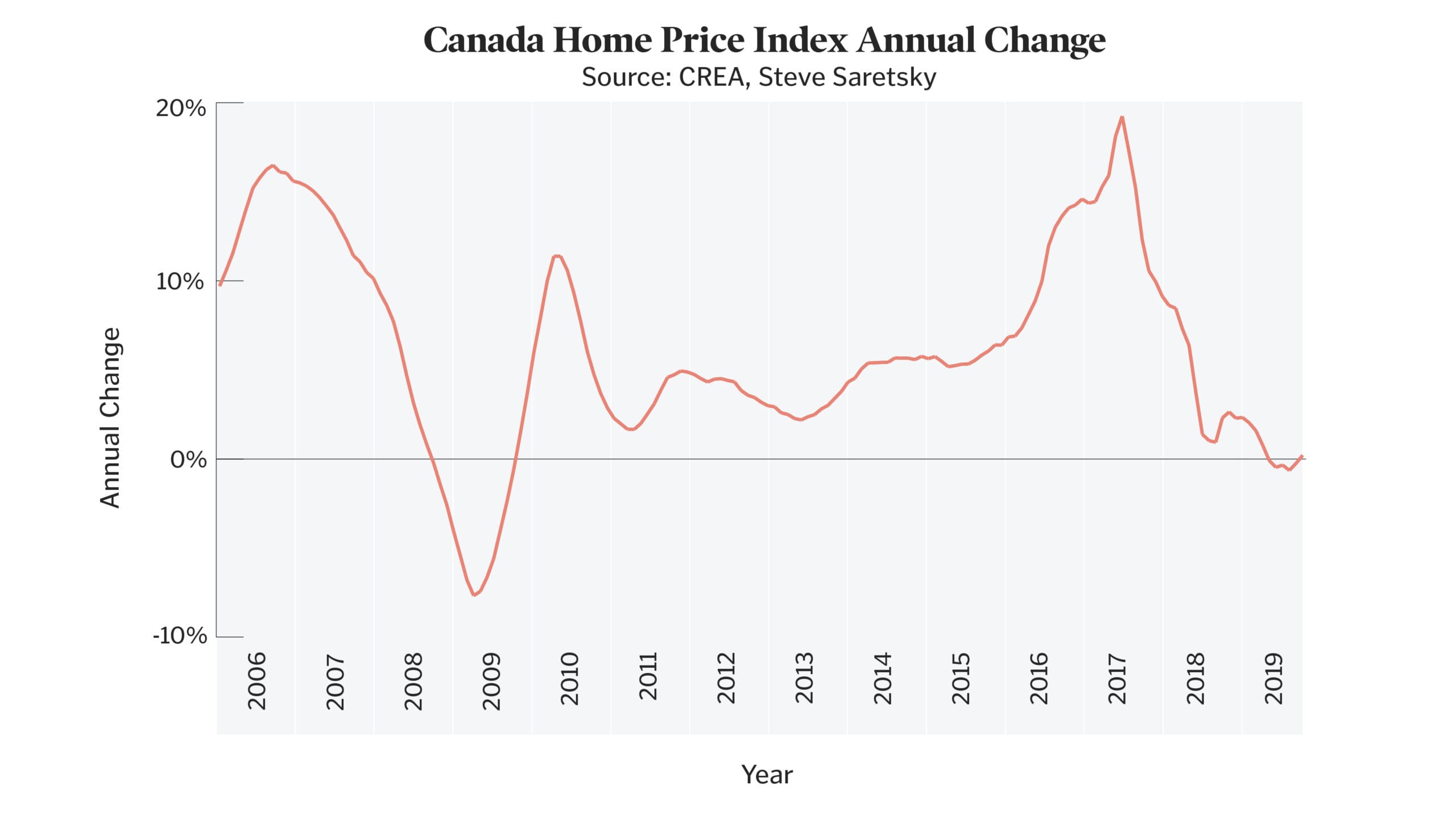

- Such provincial initiatives appear to be bearing fruit. Recent data suggest that across Canada, the year-over-year jump in home prices has recently tapered off. (See chart below.)

Primary data source: Canadian Real Estate Association. More information on the MLS Home Price Index can be found here.

10. A nationwide speculation tax may have unintended consequences. For example, it may disincentive tourism in some areas. Many residents of Whistler, B.C., Banff, Alberta, Mt. Tremblant, Quebec and Muskoka, Ontario want foreign buyers, which is why several of the provincial measures discussed above only apply to select areas of the province in question. In sum, it is not entirely clear that Canada needs a nationwide speculation tax right now. But if one is put in place, the federal government should consider varying it by region, depending on local market conditions.

Nick Falvo is a Calgary-based research consultant, a research associate at the Carleton University Centre for Community Innovation, and a CCPA research associate. Follow him on twitter at @nicholas_falvo

I wish to thank the following individuals for assistance with this blog post: Thomas Davidoff, Steve Keen, Marc Lee, David Macdonald, Michael Mendelson, Andrey Pavlov, Marc-André Pigeon, Shayne Ramsay, Steve Saretsky, Andrejs Skaburskis, Tsur Somerville, Stuart Trew, and one anonymous source. Any errors are mine.

The CCPA has done extensive research and analysis on a wide range of federal policy issues, most notably through our annual Alternative Federal Budget. As we head towards the October 2019 federal election, we’ll be sharing our independent, non-partisan analysis and fact-checking of campaign promises and platforms from all the major parties.