News & Research

Read our latest research, policy analysis and commentary

Our publications are available to all at no cost. Please support the CCPA and help make important research and ideas available to everyone. Make a donation today.

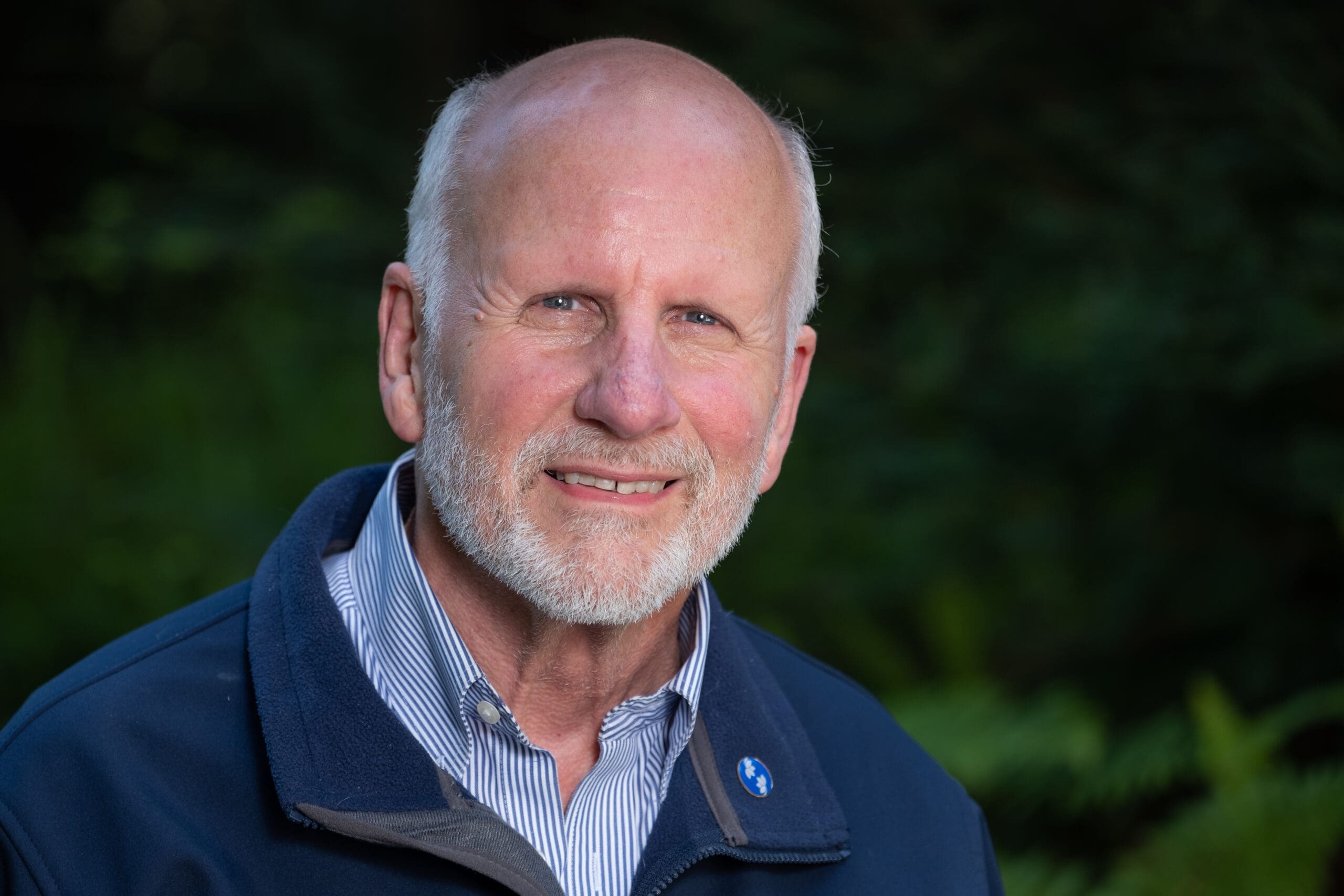

Tony Clarke’s life was an inspiration to all who seek to build a better world

Tony Clarke was an intellectual, a policy wonk, and most of all, a formidable activist for social, economic, and environmental justice for people in Canada and around the world.

Contradictions in care: Labour conditions, conflicting values, and crisis in child protection social work in Nova Scotia

The Canadian Centre for Policy Alternatives-Nova Scotia (CCPA-NS) released a new report, Contradictions in care: Labour conditions, conflicting values, and crisis in child protection social…

The power of pensions

Retirement security is the dream of every Canadian, but employers, particularly those in the private sector, are moving away from providing the gold standard of…

Working for a Living Wage

The 2024 living wage for Metro Vancouver is $27.05 per hour. This is the hourly rate that each of two parents working full-time must earn…

Much more than books

The Toronto Public Library is a vital institution that is deeply integrated into the cultural, social, and intellectual life of Torontonians. It not only provides access to knowledge but also plays a crucial role in supporting the community through programs that enrich lives, improve digital literacy, and help residents navigate the complexities of modern life.

Canada Disability Benefit

The Canadian Centre for Policy Alternatives is a charitable research institute and Canada’s leading source of progressive policy ideas, whose work is rooted in the…

Capital gains tax increase is a step towards a fairer tax system in Canada

Our content is fiercely open source and we never paywall our website. The support of our community makes this possible.

“It’s like we’re not even allowed to be Palestinian”

“My Mom brought me a keffiyeh for school for cultural day…this guy took it out of my backpack and put it on his head and…

2024 Living Wages for Newfoundland and Labrador, Nova Scotia and Prince Edward Island

As part of the Canadian Centre for Policy Alternatives’ (CCPA) continuing work to support living wages, its Nova Scotia office has released its annual living wage update…

Political pragmatism vs. poverty reduction

Previously published in the Winnipeg Free Press April 22, 2024

Canada’s climate actions must be greatly strengthened to reach net-zero emissions, new report

VANCOUVER—Canada faces daunting—but not insurmountable—challenges to meet its net-zero commitments, but government policies and incentives must match the severity of the issue in order to…

Trapped in the wage gap

Even with the June 1 minimum wage increase, one in three BC employees will earn less than their community’s living wage—over 740,000 people.Far too many…

Company men

Following two blistering years of all-time high compensation, Canada’s 100 highest-paid CEOs pocketed $13.2 million, on average, in 2023—the third biggest haul since we’ve been…

Canada’s richest 100 CEOs make 210 times more than average worker

OTTAWA—Following two blistering years of all-time high compensation, Canada’s 100 highest-paid CEOs pocketed $13.2 million, on average, in 2023—the third biggest haul since the Canadian…

What was the point of Canada’s 2024 Fall Economic Statement?

December 16, 2024 was a raucous day in Ottawa, with the sudden departure of Finance Minister Chrystia Freeland on the morning she was scheduled to…

2024 Report card on child and family poverty in Nova Scotia: Swift action is needed for child and family wellbeing

Halifax/Kjipuktuk – The Canadian Centre for Policy Alternatives-Nova Scotia (CCPA-NS) just released the 2024 Report Card on Child and Family Poverty in Nova Scotia: Swift…

Will a pro-oil president kill the oil sands?

The following is a re-print of the November 2024 edition of Shift Storm, the CCPA’s monthly newsletter which focuses on the intersection of work and…

Saskatchewan picks another fight with teachers over standardized tests

Last year, the Saskatchewan party government made the ill-advised decision to go after teachers. From bad-faith bargaining through billboards to the roundly condemned attacks on…

Canada’s fall economic statement should be about bold policy—will it be?

The federal government has the capacity to tackle big problems. Here are some big ideas that could make a difference.

2024 Manitoba Living Wage Update

The 2024 living wage for Winnipeg is $18.75 per hour. In Brandon it is $16.28 per hour, and in Thompson it is $17.90 per hour.…

Canada’s GST tax holiday won’t do much for affordability

The following article is based on speaking notes from a presentation which the author gave to the Senate Committee on National Finance. The video of…

Updates from the CCPA

Read the latest research, analysis and commentary on issues that matter to you.

CCPA Updates