News & Research

Read our latest research, policy analysis and commentary

Our publications are available to all at no cost. Please support the CCPA and help make important research and ideas available to everyone. Make a donation today.

-

Crunching the numbers on postal banking in Canada

Among the many proposals to transform Canada Post, one stands out: postal banking. It’s a program that could contribute to solving multiple policy problems at…

-

The “Combatting Hate Act” is part of a wave of anti-protest legislation in Canada

On September 19, amidst a flurry of other new federal legislation, Justice Minister Sean Fraser introduced Bill C-9, the Combatting Hate Act. The act, according…

-

Transforming Canada Post—for the better

On November 7, Canada Post submitted a proposal to the federal government outlining its proposal to restructure the postal service—a proposal which the federal government…

-

Consulting firms’ latest hustle: Using AI to write government reports

The Government of Newfoundland paid private consulting firm Deloitte $1.6 million for a Health and Human resources plan that contains fabricated sources—reminiscent of the hallucinations…

-

Video: Dream Weavers

Artists Jess Klassen and Chantel Mierau invited people to weave together a better Winnipeg at Nuit Blanche Winnipeg 2025. A strip of blue fabric for…

-

Prescription drug prices are very likely to increase in Canada

Canada has a drug price problem, and it risks getting a lot worse in the near future. Canadian prices for patented drugs are already the…

-

Updating Canadian law to address online hate and gender-based violence

Social media and online platforms are fueling a surge in hate speech, hate crimes, and technology-facilitated gender-based violence (TFGBV, in technical jargon) both in Canada…

-

Tenants are suffering: An urgent call to strengthen Nova Scotia’s rent subsidy program

Since 2021, I have been collecting research data on rent supplements (the Canada Housing Benefit) in Nova Scotia. This includes in-depth interviews with tenants who…

-

Ontario needs a teacher recruitment plan

In this year’s fall economic statement, the Ontario government repeatedly stated its intention to protect the province’s economy and people “for decades to come.” Talk…

-

COP30: Canada continues to be a global laggard on climate action

The COP30 Global Climate Summit in Belém, Brazil marked the 10th anniversary of the landmark Paris Accord, where countries agreed to limit global warming to…

-

Mortality and health care privatization: A comparison between countries

Privatization is deadly. Canada needs to learn from other countries and focus on public health care instead.

-

Talking ‘bout my generational investment: Why the federal budget fails to meet the moment

Budget 2025 featured talk of “generational investments” and proclaimed a headline number of $1 trillion in combined new public and private investment over five years.…

-

Manitoba is worse off thanks to the new federal budget

The budget tabled by the federal government on November 4 sets out a path that will worsen income inequality in Manitoba and squeezes the provincial…

-

Investment treaties, UNDRIP and the Building Canada Act

“Build big things” has become a mantra of the current federal government. Partly in an effort to lessen our economic vulnerability to U.S. shocks, Prime…

-

Still building: Child care availability in Toronto since 2022

Child care availability in Toronto has improved since 2022. But provincial funding is needed to expand access—especially in the non-profit sector.

-

Ontario Fall Economic Statement: No help on the way

Last May, CCPA’s detailed analysis of the Ontario budget argued that it failed to address years-long funding shortfalls, leaving the province vulnerable to the economic…

-

Canadian climate policy a decade after the Paris Agreement

The Paris Agreement was signed in 2015 by 196 countries amid a wave of global urgency to confront the defining crisis of our time—climate change.…

-

The path to prosperity set out in budget 2025 leaves millions behind

The millions struggling to pay their rent and put food on the table were looking for relief in budget 2025—and they were disappointed.

-

Will the feds’ climate climb down placate petro-province premiers?

Perhaps lost in yesterday’s federal budget news dominated by job cuts and military spending is the extent to which the federal government is also abandoning…

-

2025 federal budget analysis roundup

This page exists to bring together progressive policy organizations’ responses to the 2025 federal budget. Keep an eye on this page, as it will continue…

-

Post-election budget could plunge Canada into another federal election

With so much on the line, the newly elected federal government has tabled a budget that, in many ways, could pass as a Conservative budget.

-

CUSMA 2.no

Submission from the Canadian Centre for Policy Alternatives to the Government of Canada consultation on the mandated review of the Canada-U.S.-Mexico Agreement (CUSMA)

-

Elbows up: A practical program for Canadian sovereignty

A playbook for economic self-sufficiency. Because Canada can’t become a sovereign country by doing the same old things.

-

Responding to Trump demands a holistic,inclusive, sustainable national strategy

U.S. President Donald Trump’s attacks on Canada’s economy and sovereignty confront Canadians with a historic challenge. We must once again demonstrate our shared commitment to…

-

Budget cuts by stealth: Letting programs “sunset” to cut costs won’t be painless

The feds will quietly “sunset” programs as part of their cost-cutting in the November 4, 2025 budget. Quiet cuts can still hurt.

-

Alternative federal budget 2026: Health equity

What the Canadian government should do on health equity. Because true independence needs a new economic model.

-

Alternative federal budget 2026: Seniors’ and long-term care

What the Canadian government should do on seniors’ and long-term care. Because true independence needs a new economic model.

-

Alternative federal budget 2026: Acknowledgements

Many people contributed to this unique Canadian effort. Because true independence needs a new economic model.

-

Alternative federal budget 2026: Artificial intelligence

What the Canadian government should do on artificial intelligence. Because true independence needs a new economic model.

-

Budget fédéral alternatif 2026 : Éducation postsecondaire

Ce que le gouvernement canadien devrait faire en matière d’éducation postsecondaire. Une véritable indépendance exige un nouveau modèle économique.

-

Alternative federal budget 2026: Racial equity

What the Canadian government should do on racial equity. Because true independence needs a new economic model.

-

Budget fédéral alternatif 2026 : Pauvreté et sécurité du revenu

Ce que le gouvernement canadien devrait faire en matière de pauvreté et sécurité du revenu. Une véritable indépendance exige un nouveau modèle économique.

-

Alternative federal budget 2026: Incarceration

What the Canadian government should do on incarceration. Because true independence needs a new economic model.

-

Budget fédéral alternatif 2026 : Santé

Ce que le gouvernement canadien devrait faire en matière de santé. Une véritable indépendance exige un nouveau modèle économique.

-

Alternative federal budget 2026: Post-secondary education

What the Canadian government should do on post-secondary education. Because true independence needs a new economic model.

-

Budget fédéral alternatif 2026 : Fonction publique

Ce que le gouvernement canadien devrait faire en matière de fonction publique. Une véritable indépendance exige un nouveau modèle économique.

-

Alternative federal budget 2026: Gender equality

What the Canadian government should do on gender equality. Because true independence needs a new economic model.

-

Budget fédéral alternatif 2026 : Arts et culture

Ce que le gouvernement canadien devrait faire en matière des arts et culture. Une véritable indépendance exige un nouveau modèle économique.

-

Budget fédéral alternatif 2026 : Soins aux aînés et soins de longue durée

Ce que le gouvernement canadien devrait faire en matière de soins aux aînés et soins de longue durée. Une véritable indépendance exige un nouveau modèle…

-

Alternative federal budget 2026: Summary

What the Canadian government should do on post-secondary education. Because true independence needs a new economic model.

-

Alternative federal budget 2026: Arts and culture

What the Canadian government should do on arts and culture. Because true independence needs a new economic model.

-

Alternative federal budget 2026: Immigration

What the Canadian government should do on immigration. Because true independence needs a new economic model.

-

Alternative federal budget 2026: Macroeconomic and fiscal projections

Whenever the federal government’s budget is discussed, the focus quickly turns to the deficit and debt. The discussion of government debt is rarely considered in…

-

Budget fédéral alternatif 2026 : Introduction

De temps à autre, un séisme vient secouer le paysage politique. Le sol tremble sous nos pieds et les acquis que nous croyions solides s’effondrent.…

-

Budget fédéral alternatif 2026 : Environnement et changement climatique

Ce que le gouvernement canadien devrait faire en matière de l’environnement et changement climatique. Une véritable indépendance exige un nouveau modèle économique.

-

Budget fédéral alternatif 2026 : Garde d’enfants

Ce que le gouvernement canadien devrait faire en matière de garde d’enfants. Une véritable indépendance exige un nouveau modèle économique.

-

Budget fédéral alternatif 2026 : Défense

Ce que le gouvernement canadien devrait faire en matière de défense. Une véritable indépendance exige un nouveau modèle économique.

-

Alternative federal budget 2026: Child care

What the Canadian government should do on child care. Because true independence needs a new economic model.

-

Budget fédéral alternatif 2026 : Intelligence artificielle

Ce que le gouvernement canadien devrait faire en matière d’intelligence artificielle. Une véritable indépendance exige un nouveau modèle économique.

-

Budget fédéral alternatif 2026 : Commerce international

Ce que le gouvernement canadien devrait faire en matière de commerce international. Une véritable indépendance exige un nouveau modèle économique.

-

Budget fédéral alternatif 2026 : Sécurité alimentaire

Ce que le gouvernement canadien devrait faire en matière de sécurité alimentaire. Une véritable indépendance exige un nouveau modèle économique.

-

Alternative federal budget 2026: Introduction

Every now and then, an earthquake shakes the political landscape. The ground beneath our feet shakes, and the things that we believed to be solid…

-

Alternative federal budget 2026: Poverty and income security

What the Canadian government should do on poverty and income security. Because true independence needs a new economic model.

-

Alternative federal budget 2026: Environment and climate change

What the Canadian government should do on the environment and climate change. Because true independence needs a new economic model.

-

Alternative federal budget 2026: Industrial strategy and sector development

What the Canadian government should do on industrial strategy and sector development. Because true independence needs a new economic model.

-

Budget fédéral alternatif 2026 : Résumé

Depuis la signature l’Accord de libre-échange entre le Canada et les États-Unis (ALE) en 1989, notre agriculture s’est davantage intégrée à celle des États-Unis. Il…

-

Budget fédéral alternatif 2026 : Fiscalité

Ce que le gouvernement canadien devrait faire en matière de fiscalité. Une véritable indépendance exige un nouveau modèle économique.

-

Budget fédéral alternatif 2026 : Infrastructures, municipalités et transports en commun

Ce que le gouvernement canadien devrait faire en matière d’infrastructures, municipalités et transports en commun. Une véritable indépendance exige un nouveau modèle économique.

-

Budget fédéral alternatif 2026 : Équité en santé

Ce que le gouvernement canadien devrait faire en matière d’équité en santé. Une véritable indépendance exige un nouveau modèle économique.

-

Budget fédéral alternatif 2026 : Remerciements

De nombreuses personnes ont contribué à cet effort canadien unique. Car une véritable indépendance exige un nouveau modèle économique.

-

Alternative federal budget 2026: Employment Insurance

What the Canadian government should do on Employment Insurance. Because true independence needs a new economic model.

-

Alternative federal budget 2026: Public service

What the Canadian government should do on public service. Because true independence needs a new economic model.

-

Alternative federal budget 2026: Affordable housing and homelessness

What the Canadian government should do on affordable housing and homelessness. Because true independence needs a new economic model.

-

Alternative federal budget 2026: Infrastructure, cities and transit

What the Canadian government should do on infrastructure, cities and transit. Because true independence needs a new economic model.

-

Budget fédéral alternatif 2026 : Coopération internationale

Ce que le gouvernement canadien devrait faire en matière de coopération internationale. Une véritable indépendance exige un nouveau modèle économique.

-

Budget fédéral alternatif 2026 : Agriculture

Ce que le gouvernement canadien devrait faire en matière d’agriculture. Une véritable indépendance exige un nouveau modèle économique.

-

Alternative federal budget 2026: First Nations

What the Canadian government should do on First Nations. Because true independence needs a new economic model.

-

Budget fédéral alternatif 2026 : Projections macroéconomiques et budgétaires

Dès qu’il est question du budget fédéral, le débat se focalise sur le déficit et la dette. Or, la question de la dette publique est…

-

Budget fédéral alternatif 2026 : Logement abordable et itinérance

Ce que le gouvernement canadien devrait faire en matière de logement abordable et itinérance. Une véritable indépendance exige un nouveau modèle économique.

-

Budget fédéral alternatif 2026 : Anciens combattants militaires

Ce que le gouvernement canadien devrait faire en matière d’anciens combattants militaires. Une véritable indépendance exige un nouveau modèle économique.

-

Alternative federal budget 2026: Defence

What the Canadian government should do on defence. Because true independence needs a new economic model.

-

Alternative federal budget 2026: International cooperation

What the Canadian government should do on international cooperation. Because true independence needs a new economic model.

-

Alternative federal budget 2026: Agriculture

What the Canadian government should do on agriculture. Because true independence needs a new economic model.

-

Alternative federal budget 2026: Food security

What the Canadian government should do on food security. Because true independence needs a new economic model.

-

Alternative federal budget 2026: Veterans

What the Canadian government should do on veterans. Because true independence needs a new economic model.

-

Budget fédéral alternatif 2026 : Premières Nations

Ce que le gouvernement canadien devrait faire en matière des Premières Nations. Une véritable indépendance exige un nouveau modèle économique.

-

Budget fédéral alternatif 2026 : Immigration

Ce que le gouvernement canadien devrait faire en matière d’immigration. Une véritable indépendance exige un nouveau modèle économique.

-

Budget fédéral alternatif 2026 : Stratégie industrielle et développement sectoriel

Ce que le gouvernement canadien devrait faire en matière de stratégie industrielle et développement sectoriel. Une véritable indépendance exige un nouveau modèle économique.

-

Alternative federal budget 2026: Health care

What the Canadian government should do on health care. Because true independence needs a new economic model.

-

Alternative federal budget 2026: International trade

What the Canadian government should do on international trade. Because true independence needs a new economic model.

-

Budget fédéral alternatif 2026 : Assurance-emploi

Ce que le gouvernement canadien devrait faire en matière d’assurance-emploi. Une véritable indépendance exige un nouveau modèle économique.

-

Budget fédéral alternatif 2026 : Égalité des genres

Ce que le gouvernement canadien devrait faire en matière d’égalité des genres. Une véritable indépendance exige un nouveau modèle économique.

-

Budget fédéral alternatif 2026 : Incarcération

Ce que le gouvernement canadien devrait faire en matière d’incarcération. Une véritable indépendance exige un nouveau modèle économique.

-

Alternative federal budget 2026: Taxation

What the Canadian government should do on taxation. Because true independence needs a new economic model.

-

Budget fédéral alternatif 2026 : Équité raciale

Ce que le gouvernement canadien devrait faire en matière d’équité raciale. Une véritable indépendance exige un nouveau modèle économique.

-

Budget fédéral alternatif 2026 : Bâtir une vraie souveraineté canadienne

Les grandes lignes d’une souveraineté et d’une indépendance canadiennes véritables quand l’intérêt public est au cœur de la planification budgétaire

-

The rationale for Ontario’s Bill 60 does not hold up

Yesterday, the Ontario government introduced Bill 60, Fighting Delays, Building Faster Act, 2025, which contains many disconcerting, proposed changes to the Residential Tenancy Act.

-

Barely hanging on

More than a million workers in Ontario do not earn a living wage where they live—especially women and racialized workers. We calculated this estimate using…

-

To Become a Clean “Energy Superpower,” Canada Needs “Green” Steel and Iron

With the weight of the U.S. trade war challenging key export industries, Prime Minister Mark Carney and his ministers have set up camp in Washington,…

-

CUPW’s child care program is highly effective

Unions have long been champions in the fight for better child care. From organizing child care workers to speaking out for more accessible, affordable, and…

-

Time to push back against the silencing of women’s voices

This week is Gender Equality Week, first introduced by the Liberal government in 2018 to celebrate women’s achievements and to encourage all governments to tackle…

-

Oct 16 Brandon: Adult Basic Education in Western Manitoba – growing the benefits. Oct 23: report launch Winnipeg

Adult basic education is a highly effective program that can transform people’s lives. Research shows that it reduces poverty, promotes reconciliation and supports economic development.

-

Political violence is already everywhere

In recent weeks, pundits and political leaders have been united in their calls to end political violence. The killing of U.S. conservative activist Charlie Kirk…

-

Busting neoliberal myths about pharmacare in Canada

Pharmacare is in the news again. The CD Howe Institute—an important neoliberal think tank—has just released a report based on a conference it hosted on…

-

Op-ed: Pipeline politics won’t save us from Trump’s economic threats

The federal and provincial governments are scrambling to shield Canada’s economy from U.S. President Donald Trump’s latest trade tantrum. But that effort is being hijacked…

-

Carney’s initial “major projects” list disappoints. Where’s the industrial strategy?

The initial tranche of nation-building projects selected by the Carney government is as disappointing as it is predictable—but it is a failure more for what…

-

We are health care workers. We’re already seeing the impacts of climate inaction

The summer of 2025 will be remembered in Canada as the year that wildfires threatened our health and our homes, from coast to coast to…

-

The fall parliamentary session is going to be one to watch

When parliament comes back into session on September 15, the newly elected federal government is going to try to move swiftly to pass its legislative…

-

Canada is targeting Indigenous rights under the banner of the U.S. trade war

The same party might be in power, but it’s a new era for federal politics in Canada—particularly when it comes to Canada’s relationship with Indigenous…

-

A brief history of Canadian government strikebreaking

“You didn’t make any provisions before?” BNN Bloomberg host Andrew Bell asked Air Canada CEO Michael Rousseau, sounding somewhat dumbfounded. “To ensure the passengers, or…

-

Energy efficiency a better bet than pipelines

Against the backdrop of the deadly, devastating inferno engulfing northern Manitoba and escalating belligerence from the U.S., a lively debate is playing out over the…

-

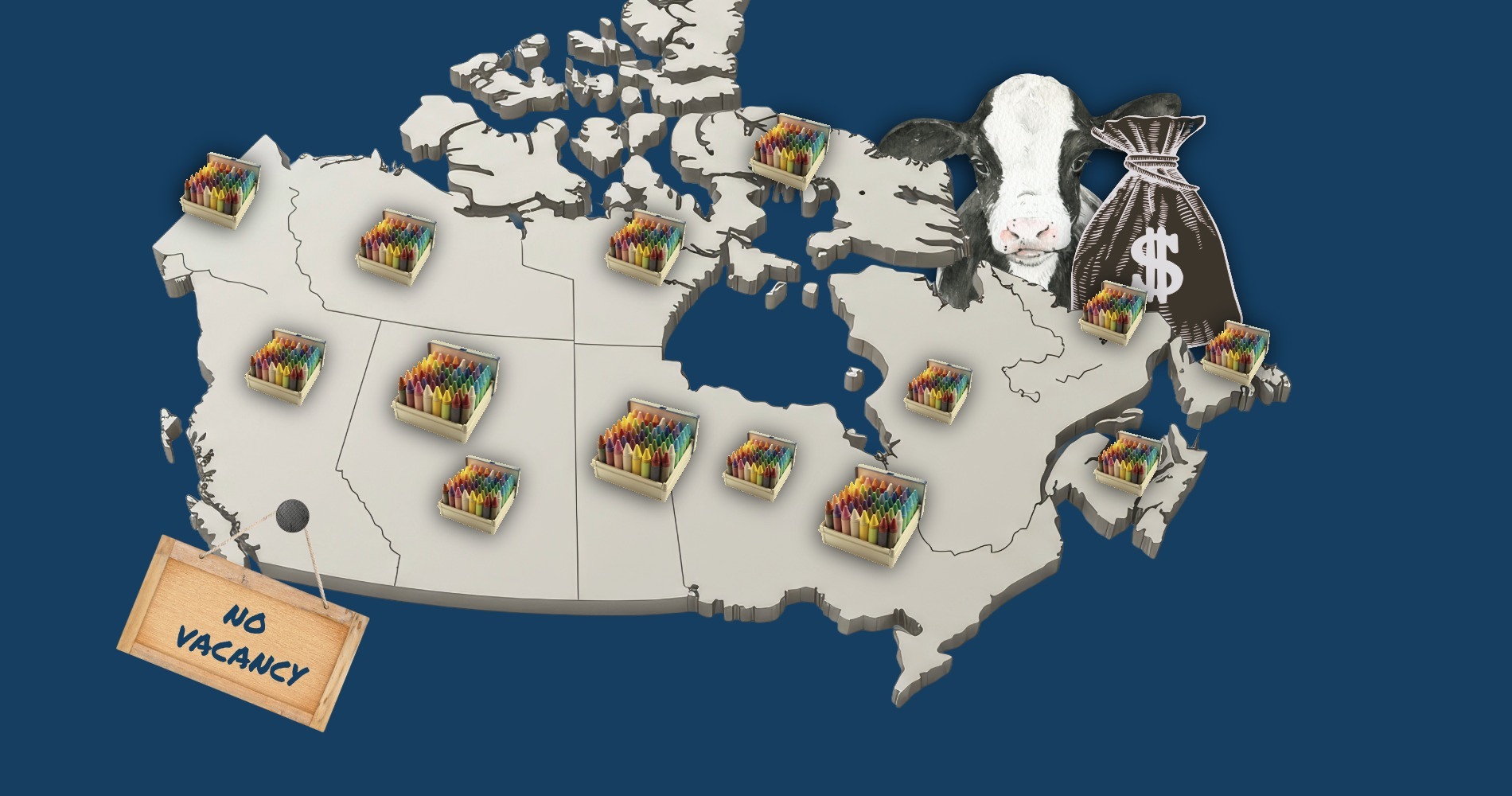

Childcare deserts in Canada: find where your community fits in 2025

Canada’s federal child care program, which began rolling out in 2021, has two main goals: lower fees to $10 per day per child, and expand…

-

This is the moment to defend the right to strike in Canada

The ongoing strike by CUPE flight attendants at Air Canada has sparked a moment in the Canadian labour movement. Unions across Canada have been pledging…

-

Building a Sovereign, Value-Added, and Sustainable Economy

U.S. President Donald Trump has confronted Canadians with unprecedented threats to our sovereignty and prosperity. From his inauguration speech, when he resuscitated the imperial doctrine…

-

Our Schools/Our Selves, Summer/Fall 2025

A snapshot of how the “parental rights” movement is unfolding across provincial and national borders

-

Canada’s fight over digital sovereignty is just getting started

U.S. President Donald Trump and former Brazilian President Jair Bolsonaro are both infamous for their unfiltered and disinformation-laden use of social media. This routine spreading…

-

To stop Gaza genocide, Canada must escalate pressure on Israel

Canadian companies, with the approval of the Canadian government, are supplying military equipment for Israel’s genocide of Palestinians in Gaza.

-

A stiff price to pay: Predicting federal job losses due to Carney’s cuts

The newly elected federal government has promised major military spending increases and tax cuts. To pay for it, the government is seeking 15 per cent…

-

Fact sheet: The Golden Dome and Canada

The United States has proposed to develop the “Golden Dome,” the most ambitious missile defence system ever envisioned. The aim is to build a multi-layered…

-

Where will the federal government cut to pay for military spending and tax cuts?

Supports to First Nations, veterans, new Canadians, and international aid could be on the chopping block—just for starters

-

Climate policy at B.C.’s carbon crossroads: 10 steps for CleanBC renewal

The end of 2025 will mark a decade since the Paris Agreement on climate change was negotiated. This review of the CleanBC plan is occurring…

-

Canadian workers deserve better work-life balance

In the post-Covid world, workers face an ever more alienated and isolated environment.

-

Canada should build public cloud infrastructure rather than relying on U.S. tech giants

During the 2025 election campaign, prime minister Mark Carney made a striking admission about Canada’s dependence on U.S. tech companies. The Canadian government was in…

-

Why did Canada just cave to Trump by scrapping the Digital Services Tax?

A lot doesn’t sit right about the Carney government’s capitulation to U.S. president Trump on the stillborn Digital Services Tax (DST), which would have taxed…

-

Liberals will need to rethink their promised budget cuts

The Liberal campaign platform promised big public sector “productivity” savings, but if you compare it to federal data, a concerning picture emerges. Some key highlights:

-

November 2 – Errol Black Chair Fundraising Brunch 2025

Keynote Speaker Peggy Nash, CCPA Executive Director Sunday November 2,

-

Youth unemployment is approaching a boiling point in Ontario

Canada is confronting a deepening youth employment emergency that policy-makers and political debates have largely overlooked, as a recent CCPA analysis highlighted.

-

Before the far right threatened democracy, neoliberalism stripped it down

Fears of the erosion of democracy pervade the headlines. The rise of authoritarian populists around the world, with Donald Trump being the most emblematic, has…

-

Let’s call Bill 5 what it is—a power grab

During Ontario’s February electoral campaign, Doug Ford capitalised on domestic and international stories which affectionately dubbed him “Captain Canada.” Donning a “Canada is Not for…

-

Ontario has underfunded schools by $6.3 billion since 2018

The 2025 Ontario budget has lots of big numbers, but fails to address funding shortfalls in core program areas. CCPA’s same-day budget analysis examined the…

-

Can the federal Build Canada Homes program finally crack the nut of housing affordability?

While housing took a backseat to the Trump trade war in the 2025 federal election, the Liberal platform included some important new plans to boost…

-

Don’t be fooled by big numbers—Ontario budget fails to address years-long funding shortfalls

A lot has happened since the last Ontario budget. U.S. President Donald Trump launched a trade war against Canada and the rest of the world.…

-

Do you trust AI to deliver your EI?

This week Prime Minister Mark Carney announced MP Evan Solomon as Canada’s first “minister for artificial intelligence (AI) and digital innovation.” There is no doubt…

-

No Time to Wait

In any public discussion of health care in Canada, the question of wait-times will inevitably come to the fore. For many, wait-times have come to…

-

2023 Living Wage for Regina and Saskatoon

The Saskatchewan Office of the Canadian Centre for Policy Alternatives’ living wage calculation for Regina and Saskatoon is a little different from past years. That’s…

-

CCPA-MB Budget Submission February 26, 2024

Honourable Minister of Finance, government officials, delegates and participants, I am pleased to present the Canadian Centre for Policy Alternatives Manitoba budget submission.

-

Fast Facts: Change Starts Here

One of the Canadian Centre for Policy Alternative Mb.’s most rewarding projects is putting together alternative municipal and provincial budgets. This year, community and academic…

-

Change Starts Here

The Canadian Centre for Policy Alternatives – Manitoba office launched its Alternative Provincial Budget (APB) which proposes a number of strategic investments the Government of…

-

Imagine a Winnipeg…

Alternative Municipal Budget 2018 Download 11.37 MB100 pages Imagine a Winnipeg… Alternative Municipal Budget, Winnipeg 2018 is a community effort that dares to imagine a…

-

Taking Back the City

2014 is an election year in Winnipeg and this Alternative Municipal Budget is meant to stimulate discussion around some of the important concerns facing our…

-

20/20: A Clear Vision for Winnipeg

The Canadian Centre for Policy Alternatives–Manitoba is pleased to present its 2010 Alternative Municipal Budget titled 20/20: A Clear Vision for Winnipeg. This budget shows…

-

Winnipeg Alternative Municipal budget 2009

The Canadian Centre for Policy Alternatives-Manitoba Alternative Municipal Budget demonstrates that it is possible to craft a City of Winnipeg operating budget that puts community…

-

2006 Manitoba Alternative Budget

Despite the generally positive indicators coming out of Manitoba’s economy, there are dark clouds looming on our horizon that cannot be ignored. The growing gap…

-

Manitoba Alternative Provincial Budget 2003-04

Download 74.58 KB 11 pages

-

Algoma Steel layoffs signal it’s time for Canada to up its game on trade and industrial policy

Algoma Steel’s announcement that it will lay off more than 1,000 workers in Sault Ste Marie is just the latest in a string of bad…

-

The Roadmap is Clear, Detours are Risky: Nova Scotia’s Child Care System at a Crossroads

The report commends the government for meeting Nova Scotia’s targets in the bilateral funding agreement with the federal government. However, significant challenges remain to realize…

-

David Macdonald speaks to Senate about Bill C-15

On December 2, CCPA Senior Economist David Macdonald was invited to speak to the Standing Senate Committee on National Finance about Bill C-15, the first…

-

Adult Education Key to Northern Economic Development

Large development projects are coming soon to northern Manitoba. Education—some now underway; some the missing piece so far—will be crucial in determining who benefits.

Updates from the CCPA

Read the latest research, analysis and commentary on issues that matter to you.

CCPA Updates