News & Research

Read our latest research, policy analysis and commentary

Our publications are available to all at no cost. Please support the CCPA and help make important research and ideas available to everyone. Make a donation today.

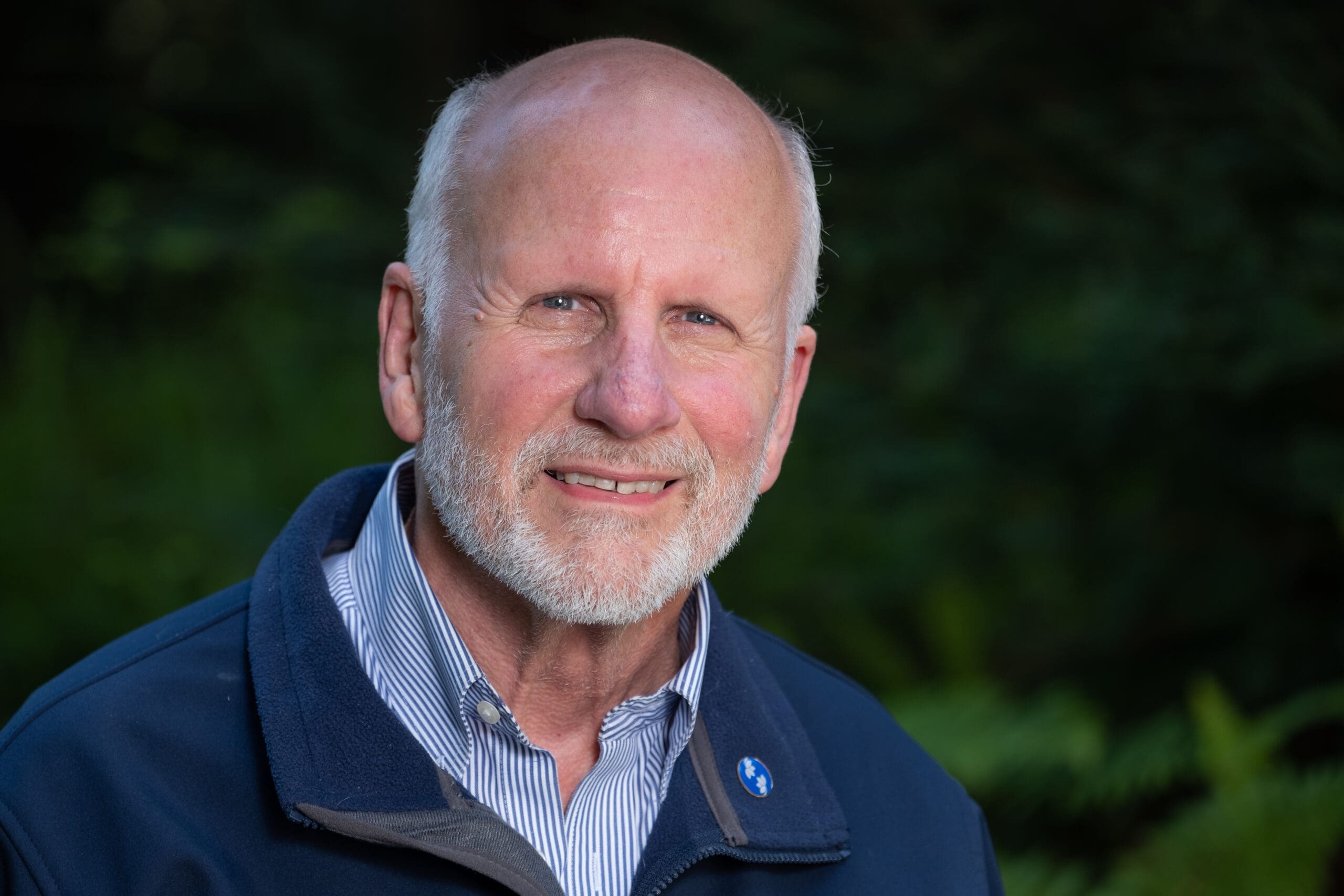

Tony Clarke’s life was an inspiration to all who seek to build a better world

Tony Clarke was an intellectual, a policy wonk, and most of all, a formidable activist for social, economic, and environmental justice for people in Canada and around the world.

Contradictions in care: Labour conditions, conflicting values, and crisis in child protection social work in Nova Scotia

The Canadian Centre for Policy Alternatives-Nova Scotia (CCPA-NS) released a new report, Contradictions in care: Labour conditions, conflicting values, and crisis in child protection social…

The power of pensions

Retirement security is the dream of every Canadian, but employers, particularly those in the private sector, are moving away from providing the gold standard of…

Working for a Living Wage

The 2024 living wage for Metro Vancouver is $27.05 per hour. This is the hourly rate that each of two parents working full-time must earn…

Much more than books

The Toronto Public Library is a vital institution that is deeply integrated into the cultural, social, and intellectual life of Torontonians. It not only provides access to knowledge but also plays a crucial role in supporting the community through programs that enrich lives, improve digital literacy, and help residents navigate the complexities of modern life.

Canada Disability Benefit

The Canadian Centre for Policy Alternatives is a charitable research institute and Canada’s leading source of progressive policy ideas, whose work is rooted in the…

Capital gains tax increase is a step towards a fairer tax system in Canada

Our content is fiercely open source and we never paywall our website. The support of our community makes this possible.

“It’s like we’re not even allowed to be Palestinian”

“My Mom brought me a keffiyeh for school for cultural day…this guy took it out of my backpack and put it on his head and…

2024 Living Wages for Newfoundland and Labrador, Nova Scotia and Prince Edward Island

As part of the Canadian Centre for Policy Alternatives’ (CCPA) continuing work to support living wages, its Nova Scotia office has released its annual living wage update…

Political pragmatism vs. poverty reduction

Previously published in the Winnipeg Free Press April 22, 2024

Canada’s climate actions must be greatly strengthened to reach net-zero emissions, new report

VANCOUVER—Canada faces daunting—but not insurmountable—challenges to meet its net-zero commitments, but government policies and incentives must match the severity of the issue in order to…

Trapped in the wage gap

Even with the June 1 minimum wage increase, one in three BC employees will earn less than their community’s living wage—over 740,000 people.Far too many…

Unprecedented increases to living wages—New Report

CLICK HERE TO VIEW THE FULL REPORT Halifax/Kjipuktuk—The Canadian Centre for Policy Alternatives-Nova Scotia has released its annual living wage update for Nova Scotia. The new wages for two adults…

Property tax reform can address economic and housing inequality in BC, new research

READ THE FULL REPORT HERE. VANCOUVER–The explosion of housing prices has become a massive source of inequality in BC, which can be addressed with progressive property tax reform, new research…

Un nouveau rapport met en lumière l’état de l’industrie des combustibles fossiles dans l’Est du Canada – une région négligée dans les débats sur les politiques énergétiques

CLIQUEZ ICI POUR CONSULTER LE RAPPORT [HALIFAX/ Kjipuktuk, 6 juin 2023]: Bien que l’Est du Canada soit fortement investi dans la production pétrolière et gazière, cette région est souvent omise…

New report shines light on the state of fossil fuel industry in Eastern Canada – an overlooked region in energy transition debates

CLICK HERE TO VIEW THE FULL REPORT [HALIFAX/ Kjipuktuk, June 6, 2023] – Despite Eastern Canada being highly invested in oil and gas production, the region is often left out…

Report: Half of Canada’s young children still live in child care deserts due to shortage of licensed spaces

Lowering fees to $10-a-day is a good plan, but parents are still hard-pressed to find licensed spaces READ THE FULL REPORT HERE. OTTAWA—With 48 per cent of younger children living…

Pay Gap in Manitoba – New Report Launched at Press Conference on April 27th, 2023.

Winnipeg, Treaty One–A new report Tired of Waiting: Rectifying Manitoba’s Pay Gap published by the Canadian Centre for Policy Alternatives is being launched at a press conference 10 AM CST,…

Nova Scotia Alternative Budget 2023: Leave No One Behind

READ THE FULL REPORT HERE. Halifax/Kjipuktuk -The Canadian Centre for Policy Alternatives-Nova Scotia (CCPA-NS) released the Nova Scotia Alternative Budget 2023: Leave No On Behind. The Nova Scotia Alternative Budget…

What we are looking for at the 2023/24 Manitoba Budget speech

March 7, 2023 For Immediate Release (Winnipeg, Treaty One Territory): CCPA Senior Researcher and Errol Black Chair in Labour Issues Niall Harney and CCPA Manitoba director Molly McCracken will be…

Response to True North Real Estate purchase option for Portage Place Mall

READ THE FULL REPORT HERE. WATCH THE VIDEO HERE. WINNIPEG/TREATY ONE–True North Real Estate purchase option goes against the community vision for Portage Place land and mall. In 2021, the…

Over 125 organizations and advocates demand BC enact pay equity legislation

READ THE OPEN LETTER. VANCOUVER, UNCEDED XʷMƏΘKʷƏY̓ƏM (MUSQUEAM), SḴWX̱WÚ7MESH (SQUAMISH) AND SƏLILWƏTAɬ (TSLEIL-WAUTUTH) HOMELANDS – A coalition of more than 125 leading BC organizations, academics, and advocates are calling on…

New report: Canada isn’t spending what it takes to succeed in the global shift to a clean economy; Budget 2023 must include ambitious climate investment plan

CLICK HERE TO VIEW THE FULL REPORT Unceded Algonquin Anishinaabe Territories [OTTAWA], 9 February 2023 For Canada to compete in the global clean economy, the federal government must adopt an…

Manitobans want to maintain education property taxes to pay for public education

READ THE FULL REPORT HERE. For Immediate Release (Winnipeg, Treaty One): Manitobans want the provincial government to keep the money earmarked for the Education Property Tax Rebate and spend it…

Updates from the CCPA

Read the latest research, analysis and commentary on issues that matter to you.

CCPA Updates