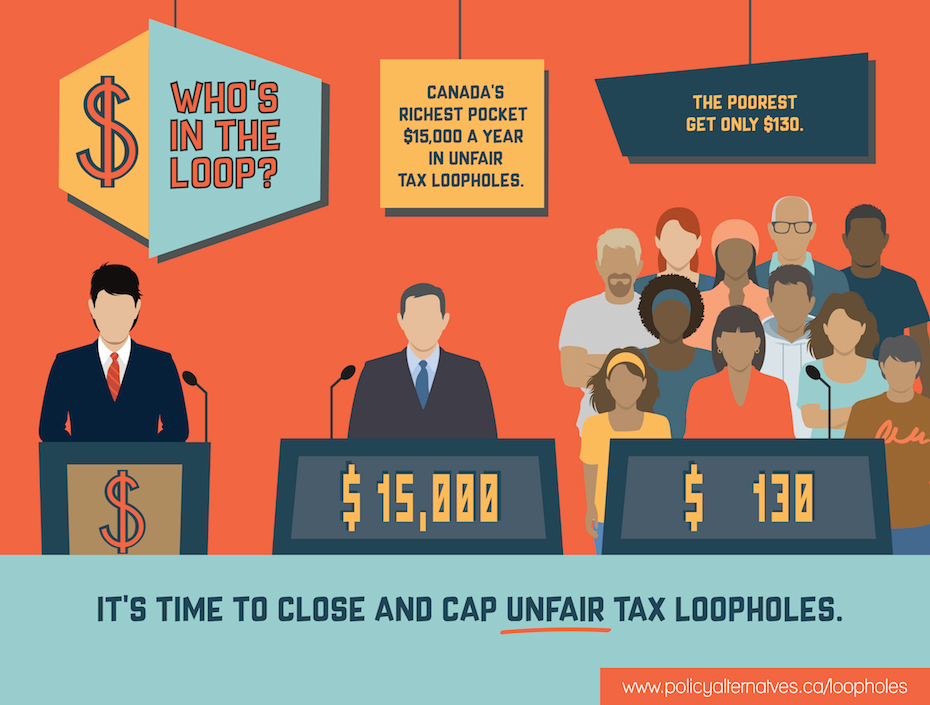

Unfair tax loopholes cost the federal government $103 billion dollars each year—but not everyone’s in the loop. These loopholes disproportionately benefit the rich, and perpetuate income inequality.

Did you know that if the five worst tax loopholes were closed, the federal government could use that money to create an affordable national child care program AND eliminate university tuition?

It’s time to make fiscal choices that benefit everyone, not just a select few. Find out how in our report, and help us spread the word by sharing the image below.